What Does the US Import from China? Full Breakdown of America’s Top Imports

When you pick up your smartphone, glance at your shoes, or unpack a new kitchen gadget, chances are high that it has “Made in China” stamped somewhere on it.

The economic bridge between the United States and China is built on a powerful engine of imports and exports, and this relationship is far from casual—it’s a cornerstone of the global economy.

But what exactly does the U.S. import from China, and why does it matter so much?

This isn’t just a list of goods—it’s a narrative of dependence, convenience, innovation, and, sometimes, controversy. The U.S. leans heavily on China to fulfill a variety of consumer and industrial needs.

From electronics that power your day to the clothes on your back, Chinese imports saturate American homes, businesses, and even hospitals.

In this article, we’ll peel back the layers of this complex trade web.

We’ll explore which items top the import charts, how this trade relationship evolved, and what it means for the future of American manufacturing, jobs, and global influence.

Buckle up, because this is more than just economics—it’s about how the world is wired together.

Table of Contents

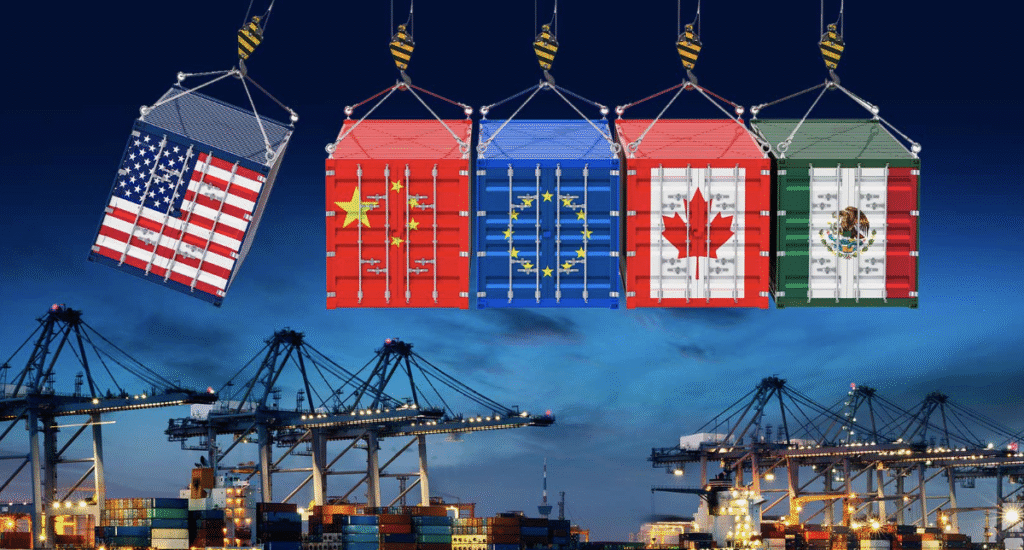

The Scale of US Imports from China

The United States imports hundreds of billions of dollars’ worth of goods from China every year, making China one of its top trading partners. This trade volume didn’t appear overnight—it’s the result of decades of economic strategy, global market shifts, and consumer demand.

In 2023 alone, the U.S. imported over $450 billion in goods from China, according to the U.S. Census Bureau. Despite political tensions and supply chain disruptions, China continues to be the top source of imported goods for the U.S. The variety is staggering, ranging from advanced electronic components to everyday items like clothing and kitchenware.

This massive scale of trade has both lifted the American lifestyle with affordable goods and raised concerns about dependency on a foreign nation for essential products.

For better or worse, Chinese imports are embedded in the daily operations of U.S. businesses and the lives of American consumers.

Trade Volume Over the Last Decade

Take a look back to 2010, and you’ll see a consistent climb in import values. Trade between the two nations grew sharply throughout the 2010s. Even amidst policy shocks like tariffs introduced during the Trump administration and the disruptions of COVID-19, Chinese exports to the U.S. remained resilient.

From 2010 to 2018, the U.S. saw steady growth in imports from China, peaking at $539 billion in 2018. After a dip in 2019 and 2020 due to tariffs and the pandemic, the volume rebounded in 2021 and 2022. This data showcases China’s unmatched manufacturing scale and its role as the global “factory floor.”

Despite rising labor costs in China and calls for diversification, American companies still find it challenging to replicate the same speed, cost-effectiveness, and scale elsewhere. That’s why the numbers remain high, even with alternatives emerging.

Impact of Tariffs and Trade Wars

The introduction of tariffs during the U.S.–China trade war from 2018–2020 was a seismic shift. For the first time in decades, American companies had to rethink their sourcing strategies. Products like electronics, furniture, and industrial goods faced levies that made them more expensive.

Did this reduce imports? Briefly, yes. But in many cases, companies either passed the cost on to consumers or found workarounds, such as routing goods through other countries. Instead of completely cutting ties, many businesses adjusted supply chains while still keeping China at the center.

What this period revealed was the depth of U.S. reliance on Chinese goods. Even punitive measures couldn’t significantly shift the core dynamics. And while the Biden administration has continued to enforce many of these tariffs, imports from China remain strong—a testament to China’s deeply entrenched position in global supply chains.

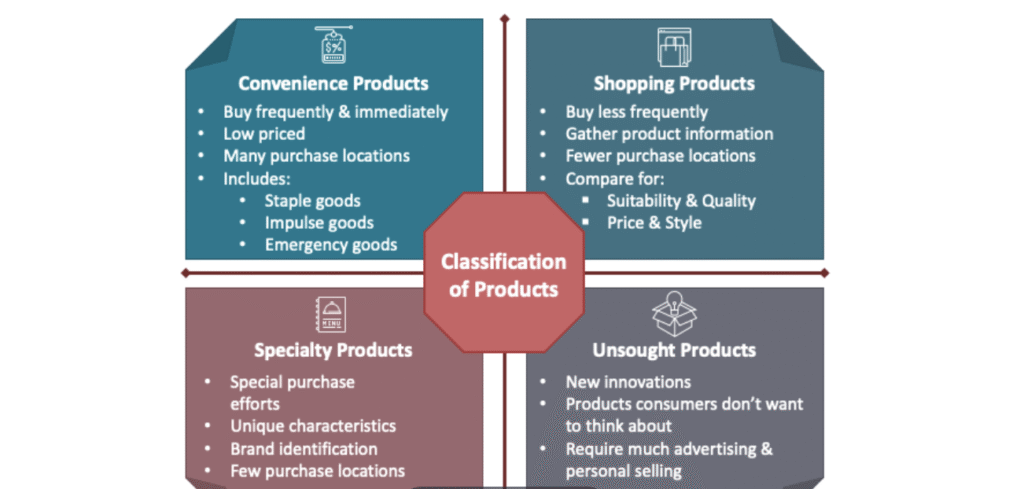

Top Categories of Chinese Imports

Now that we understand the scale, let’s dive into the specifics. What exactly is the U.S. buying from China? Here are the biggest categories of imports that dominate trade lanes across the Pacific.

Electronics and Machinery

This is the undisputed giant. Think about smartphones, laptops, routers, flat-screen TVs, and more. These goods are among the top imports from China, and for good reason—China is the world’s electronics manufacturing powerhouse.

Apple, for example, assembles its iPhones primarily in China through partnerships with companies like Foxconn. Beyond consumer electronics, the U.S. also imports vast amounts of industrial machinery, telecommunications equipment, and components like printed circuit boards and semiconductors.

In 2023, electronics and machinery alone accounted for over $120 billion of U.S. imports from China. This includes:

- Mobile phones and components

- Computers and accessories

- Electrical transformers and generators

- TVs and monitors

- Industrial robots and machine tools

What makes China dominant in this category? It’s not just cheap labor—it’s a combination of an established ecosystem, trained workforce, and investment in logistics infrastructure. Moving away from this level of integration would take years, if not decades.

Furniture and Home Goods

Step into an average American household, and it becomes obvious how reliant consumers are on Chinese-made furniture and home decor. China leads the world in manufacturing household items, and U.S. imports reflect that dominance.

In 2023, the U.S. imported over $30 billion worth of furniture and bedding from China. This includes:

- Sofas and sectionals

- Beds and mattresses

- Office chairs and desks

- Wooden and metal furniture

- Home lighting and fixtures

These goods are relatively low-tech but expensive to produce domestically due to labor costs. That’s why manufacturers prefer to outsource production to Chinese factories that can produce at scale with consistent quality.

The demand for affordable home upgrades—especially during the COVID-19 pandemic when Americans were remodeling in record numbers—boosted these imports even further.

Clothing and Textiles

Walk into any major retail store in the U.S., and you’ll find racks upon racks of clothing with “Made in China” labels. The textile and apparel industry has long been a cornerstone of Chinese exports, and the U.S. is one of its biggest customers. Even with rising competition from countries like Bangladesh, Vietnam, and India, China remains a dominant force in this category.

In 2023, the U.S. imported nearly $25 billion in clothing, textiles, and footwear from China. This includes:

- Men’s and women’s clothing

- Children’s apparel

- Footwear and sandals

- Handbags, backpacks, and accessories

- Synthetic and natural fabrics

Why China? The Chinese textile sector has mastered the art of rapid production, scalability, and low costs. American fashion brands—from budget chains to high-end labels—often rely on Chinese factories to deliver seasonal collections quickly and efficiently.

The versatility of China’s textile industry allows for both mass-market products and more refined, specialized apparel. Additionally, their integrated supply chain—from fabric production to final sewing—enables faster turnaround, which is crucial for fast fashion.

Despite increasing awareness around ethical sourcing and sustainability, the demand for low-cost fashion hasn’t slowed. As long as price remains king, Chinese apparel will continue to dominate U.S. imports.

Toys and Sports Equipment

When it comes to toys, China is the undisputed leader. Nearly 80% of all toys sold in the U.S. come from Chinese manufacturers. From action figures to board games, and outdoor playsets to plush animals—chances are, if it’s fun and plastic, it’s Chinese.

In 2023, this sector accounted for approximately $15 billion in imports to the U.S. Some of the popular product lines include:

- Electronic toys and video game accessories

- Dolls, action figures, and plush toys

- Board games and puzzles

- Sports balls, fitness equipment, and bicycles

- Seasonal decorations and party supplies

Major global brands like Mattel, Hasbro, and LEGO rely heavily on manufacturing operations in China. The reason is simple: low production costs, advanced molding technology, and streamlined logistics make China the go-to place for toys.

Even U.S.-based toy companies find it economically unfeasible to shift production elsewhere. And while there have been pushes for diversification—especially after tariff scares and supply chain issues during COVID-19—the industry remains deeply tied to Chinese manufacturers.

The same applies to sports and fitness gear. Whether it’s resistance bands, yoga mats, or home gym machines, China’s role in producing this equipment for American retailers like Walmart, Target, and Amazon sellers is unmatched.

Niche but Significant Imports

While electronics, furniture, and clothing steal the spotlight, there are several categories of imports that might not be as flashy but are absolutely essential. These behind-the-scenes goods keep the American economy functioning smoothly—from hospitals to highways to factories.

Medical Supplies

The pandemic put a spotlight on just how dependent the U.S. is on China for medical supplies. PPE shortages revealed vulnerabilities in the supply chain, particularly around masks, gloves, and other protective gear.

Even beyond COVID-related items, the U.S. imports a vast array of medical products from China, such as:

- Surgical masks and respirators

- Latex and nitrile gloves

- Medical gowns and drapes

- Syringes and IV equipment

- Thermometers and pulse oximeters

In 2023, this category brought in an estimated $10 billion in goods. Hospitals, clinics, and pharmacies across the U.S. rely on these imports daily. It’s not just about affordability—China has scaled up production capacity to meet global healthcare demands.

However, this dependency has sparked bipartisan calls for reshoring critical medical manufacturing, with new federal incentives introduced to encourage domestic production. Still, shifting large-scale medical supply chains away from China will be an uphill climb.

Automotive Parts

Cars assembled in Detroit or Tennessee still contain components from factories halfway across the globe. China is a major supplier of auto parts to the United States, even if the final assembly happens domestically.

The U.S. imports roughly $9 billion in Chinese automotive parts annually. These include:

- Brake pads and rotors

- Electronic control units (ECUs)

- Wiring harnesses and sensors

- Batteries for electric vehicles

- Lights, dashboards, and interior trim

As electric vehicles (EVs) become more mainstream, this trade is set to grow. China leads in the production of lithium-ion battery components, crucial for EVs. Brands like Tesla even source certain parts from Chinese suppliers, underscoring how interwoven these supply chains have become.

While tariffs and transportation issues have challenged this trade, automakers often find it hard to pivot, especially when Chinese factories offer precision manufacturing at a fraction of the cost.

Plastics and Packaging Materials

From packaging peanuts to industrial-grade polymer sheets, the U.S. brings in a significant amount of plastic goods from China. These materials are critical for manufacturing, shipping, and retail.

Imports in this category total over $8 billion and cover:

- Plastic films and sheets

- Bottles, caps, and containers

- Packaging materials and foams

- Plastic kitchenware and storage items

These products are essential across multiple industries including food, automotive, tech, and logistics. The primary reason for importing? Once again—cost and scale. China’s petrochemical industry supports a massive plastic production network that few other countries can match.

And even as sustainability efforts grow, the demand for affordable and versatile plastic products continues to climb, especially among e-commerce and retail businesses in the U.S.

How These Imports Affect the US Economy

The sheer volume and variety of goods the U.S. imports from China have a profound impact on the American economy. On the surface, this relationship delivers cost savings and product diversity, but deeper down, it also raises strategic, ethical, and logistical concerns. It’s a double-edged sword—bringing both advantages and vulnerabilities.

Affordability for Consumers

One of the most immediate and tangible effects of Chinese imports is the affordability they bring to American consumers.

Thanks to the scale and efficiency of Chinese manufacturing, everyday goods are available in the U.S. at prices that would be nearly impossible to match with domestic production.

Picture this: a consumer walks into a store or browses online and finds a $15 toaster, a $10 T-shirt, or a $500 flat-screen TV. These low prices are not coincidental—they’re a direct result of the cost-efficiency of Chinese production. This allows American families to stretch their budgets further and access a wider variety of goods, from essentials to luxuries.

Retailers also benefit by maintaining competitive pricing and offering diverse product lines. Whether it’s Walmart, Amazon, or local department stores, the ability to import from China keeps profit margins healthy while keeping customers satisfied.

However, while this dynamic supports consumer purchasing power, it can also discourage domestic manufacturing. U.S. factories struggle to match the low prices of their Chinese counterparts, leading to factory closures and job losses in certain sectors.

Supply Chain Dependencies

Perhaps the most significant concern regarding Chinese imports is the dependency they create. The U.S. has grown so reliant on China for certain goods that disruptions—be it political, natural, or pandemic-related—can send shockwaves through industries.

We saw this in stark relief during the COVID-19 pandemic, when shipments of medical supplies, electronics, and auto parts were delayed or halted, exposing the vulnerabilities of globalized supply chains. Even a minor slowdown in Chinese ports can affect production timelines and inventory across the U.S.

This dependency has triggered national security debates and led policymakers to advocate for more domestic production of strategic goods. Think semiconductors, pharmaceuticals, and military-related tech. Yet, replacing or replicating China’s supply chain infrastructure is easier said than done.

Additionally, as China continues to move up the value chain—producing more high-tech goods—the dependency grows. American companies in sectors like electric vehicles, biotech, and telecommunications now rely on China not just for basic components, but for advanced materials and technologies.

Shifts in Import Trends

Despite the long-standing trade relationship, the winds are shifting. Driven by politics, economics, and new global challenges, U.S. companies are reassessing their reliance on Chinese imports. Diversification has become the buzzword, and the strategies behind it are as varied as the goods being imported.

Moves Toward Domestic Manufacturing

The conversation around “Made in America” is no longer just political rhetoric—it’s turning into policy. The U.S. government has introduced incentives to bring manufacturing back home, especially in sectors deemed critical for national security and economic resilience.

For example:

- The CHIPS and Science Act: Allocates over $50 billion to boost semiconductor production in the U.S.

- Infrastructure Investment and Jobs Act: Encourages sourcing of domestic materials for public projects.

- Buy American policies: Favor local suppliers in federal procurement.

Major companies are responding. Intel and TSMC have announced new chip plants in Arizona. Tesla is looking to scale up domestic parts production. Even smaller companies are exploring reshoring opportunities thanks to automation, which can offset labor cost disadvantages.

However, this shift won’t be immediate. Building new factories, training workers, and setting up local supply chains takes time and capital. Still, the seeds are being planted for a more self-reliant manufacturing ecosystem.

Imports from Alternatives like Vietnam or Mexico

As companies seek to reduce exposure to China, countries like Vietnam, India, Bangladesh, and Mexico are stepping into the spotlight. These nations offer cost-effective manufacturing with fewer geopolitical risks.

Vietnam, in particular, has emerged as a key alternative for textiles, furniture, and electronics. Samsung has significant operations there, and brands like Nike and Adidas have shifted some of their production from China to Vietnamese factories.

Mexico offers a different kind of advantage—proximity. Nearshoring to Mexico reduces shipping times and costs, making it attractive for industries like automotive, aerospace, and consumer goods.

That said, none of these countries can match China’s infrastructure, capacity, and integration—at least not yet. Most businesses are pursuing a “China Plus One” strategy: maintain Chinese operations while expanding into other countries to hedge their bets.

Environmental and Ethical Considerations

While cost and convenience often drive the decision to import from China, there’s a growing awareness around the environmental and ethical implications of this trade.

On the environmental front, China’s rapid industrialization has come at a steep price. Many of the goods exported to the U.S. are produced in energy-intensive factories that contribute to pollution and carbon emissions. Critics argue that while the U.S. enjoys cheap products, the environmental costs are effectively outsourced.

Labor practices in Chinese factories also face scrutiny. There are longstanding concerns about:

- Poor working conditions

- Low wages

- Lack of labor rights

- Use of forced labor in regions like Xinjiang

Brands importing from China are increasingly under pressure to audit their supply chains, ensure fair labor practices, and reduce environmental harm. Some companies are moving toward ESG compliance (Environmental, Social, and Governance) to meet investor and consumer expectations.

These ethical dilemmas are prompting a shift in purchasing habits—especially among younger consumers who prefer brands with transparent and responsible sourcing. While this hasn’t caused a seismic drop in imports yet, it’s reshaping the narrative and could influence future trade patterns.

The Role of Technology in Import Management

In the digital age, the way the U.S. manages and monitors its imports from China has evolved significantly. Technology now plays a central role in streamlining logistics, managing risk, improving transparency, and ensuring compliance. The adoption of cutting-edge tools helps companies stay competitive, even in the complex world of global trade.

One of the biggest challenges of importing from China is navigating the logistics—think shipping delays, customs clearance, documentation, and real-time tracking. Advanced supply chain management systems now allow importers to monitor their shipments 24/7, predict delays, and automatically reroute cargo if necessary.

Blockchain technology is also making waves. With blockchain, every step in the product journey—from factory floor to U.S. port—is recorded in a secure, unchangeable ledger. This increases trust and traceability, especially for sensitive or high-value goods. It’s particularly useful in industries like pharmaceuticals, where product authenticity is crucial.

AI and machine learning tools help importers analyze trends, forecast demand, and optimize inventory. This means businesses can place smarter orders, avoid overstocking or understocking, and respond quickly to market changes. These systems also flag potential compliance risks, like import violations or missing documentation.

Customs brokers and freight forwarders are also embracing tech to speed up the import process. Digital platforms now offer end-to-end logistics solutions—handling everything from product sourcing in China to final delivery in the U.S.—without the traditional delays and paperwork hassles.

Technology doesn’t just make importing easier; it makes it smarter. With rising scrutiny, geopolitical uncertainties, and tighter regulations, digital tools help American companies stay agile, efficient, and legally compliant in their trade with China.

Future Outlook of US-China Trade

So, what lies ahead for one of the world’s most vital economic relationships? While the U.S.–China trade bond remains strong, it’s also under more pressure than ever. Political tension, economic nationalism, and supply chain reform efforts are pushing both countries to rethink their strategies.

Looking forward, several trends are likely to shape the future:

1. Increased Regulatory Oversight

U.S. lawmakers are pushing for more stringent screening of Chinese imports—especially in tech, medicine, and defense-related sectors. Expect more policies aimed at protecting intellectual property, ensuring ethical labor practices, and promoting national security.

2. Supply Chain Diversification

As we’ve already seen, many companies are moving toward “China Plus One” strategies. This trend is likely to accelerate, with more sourcing coming from Southeast Asia, Latin America, and even the U.S. itself. However, China won’t be replaced overnight—it will remain a major player.

3. Green Trade and Sustainability

Both governments and consumers are demanding more environmentally friendly practices. Future trade may involve stricter carbon emission regulations, ESG reporting standards, and incentives for green products and processes.

4. Digital Trade Expansion

E-commerce is booming, and cross-border digital trade is growing with it. Platforms like Alibaba and JD.com are redefining how businesses buy from Chinese suppliers. This shift could create new efficiencies—and new regulatory headaches.

5. Strategic Decoupling

While full economic separation is unlikely, some degree of decoupling is underway. Critical industries like semiconductors, rare earth materials, and military technology will see more government intervention and reduced dependency on Chinese sources.

In summary, the future of U.S.–China trade won’t be a simple continuation of the past. It will be a more cautious, calculated, and technologically enhanced relationship, shaped by global forces and domestic priorities.

Conclusion

The question “What does the U.S. import from China?” opens the door to a complex and deeply interconnected world. It’s not just about cheap electronics or low-cost clothing—it’s about how two global superpowers depend on each other in ways that shape economies, politics, innovation, and everyday life.

From smartphones and sofas to medical masks and microchips, Chinese imports touch nearly every aspect of American society. While this relationship has offered enormous economic benefits, it has also introduced new challenges—economic dependency, ethical dilemmas, and national security concerns.

As the U.S. looks to the future, balancing the benefits of trade with the risks of overreliance will be critical. Whether through diversification, domestic manufacturing, or smarter technology use, the goal is clear: resilience without losing the advantages that global trade brings.

The U.S.–China import story isn’t ending—it’s just evolving. And staying informed is the first step to understanding where it’s headed next.

FAQs What does the US import from China?

1. What are the top products the U.S. imports from China?

The U.S. imports a wide range of products from China, with top categories including electronics, machinery, furniture, textiles, toys, medical supplies, and automotive parts.

2. Why does the U.S. rely so heavily on China for imports?

China offers a unique combination of low labor costs, massive production capacity, integrated supply chains, and efficient logistics—making it difficult for other countries to compete at the same scale and price.

3. Are there efforts to reduce U.S. dependence on Chinese imports?

Yes. The U.S. is encouraging domestic manufacturing and exploring alternatives like Vietnam, India, and Mexico through policies like the CHIPS Act and trade diversification strategies.

4. How did the COVID-19 pandemic affect U.S.–China trade?

The pandemic exposed weaknesses in global supply chains, particularly in medical supplies and electronics. While trade volumes dipped temporarily, imports from China have since rebounded.

5. What industries are most vulnerable to Chinese supply chain disruptions?

Industries such as electronics, automotive, healthcare, and consumer goods are most at risk due to their reliance on Chinese manufacturing and components.